NVDA F2Q25 Earnings: Ramp Schedule Revisit

Results are solid and there is a lot to like from here

Earnings Quick Take

Updated Ramp Schedule

#s are solid and signals are positive in my view, despite well-understood delay: strong Hopper filling the gap of delayed Blackwell, Blackwell 4Q ramp with several $billions revenue this year, Networking back to solid sequential growth, sovereign AI guide upgraded, and Software exiting the year with $2B ARR indicating 100% growth y/y. We think there is a lot to like about this print vs. fear/dislike, given the delay is well-understood by the street. Jensen provided a more normalized Blackwell ramp timeline and reset the expectation.

Why the strong demand for Hopper? 2nd tier customers who can’t get enough access to Blackwell in a year will view H100/200 as the only choices because time is valuable. Remember during the early ramp of H100, lead time was once 40+ weeks. If we take that into account (but also considering improving TSMC supply), 2nd tier customers may not have enough Blackwell (especially GB200) in their DC until 2H25. If companies are racing to develop products or models, they can’t wait this long.

Why the stock -6%? Sequential smaller 2Q sales beat (4.5% beat vs. 5.9% in 1Q) and 3Q sales guide beat (2.5% beat vs. 5.2% in 1Q) look tricky, missing some of the $33-34B 3Q expectations. And the implied 4Q ~73% GM and increasing OpEx guide create some bottom-line worry. Even the delay is well-understood, the ~40% rally before the print represents a crowded bet-into-earnings given favorable r/r at $100/110. Also There is little juice to squeeze at $130 and I won’t be surprised some of the HFs closing their position and securing the profits after the drawdown. Overall, I don’t think the earnings deliver any downside to the AI demand big picture and NVDA’s unshakable position. Any ST noises will represent good buy-in opportunities.

Bright spots:

Confirmed strong Hopper demand, H200 ramping, longer Hopper lifespan given Blackwell delay

Networking back to q/q growth, growing nicely at 16%

Sovereign AI guided low DD billions this year vs. high SD guide in 1Q

Software exiting this year with $2B ARR, a 100% growth from $1B last year

Things worth watching:

Blackwell production ramp in 4Q

Blackwell GM impact and OPEX increase

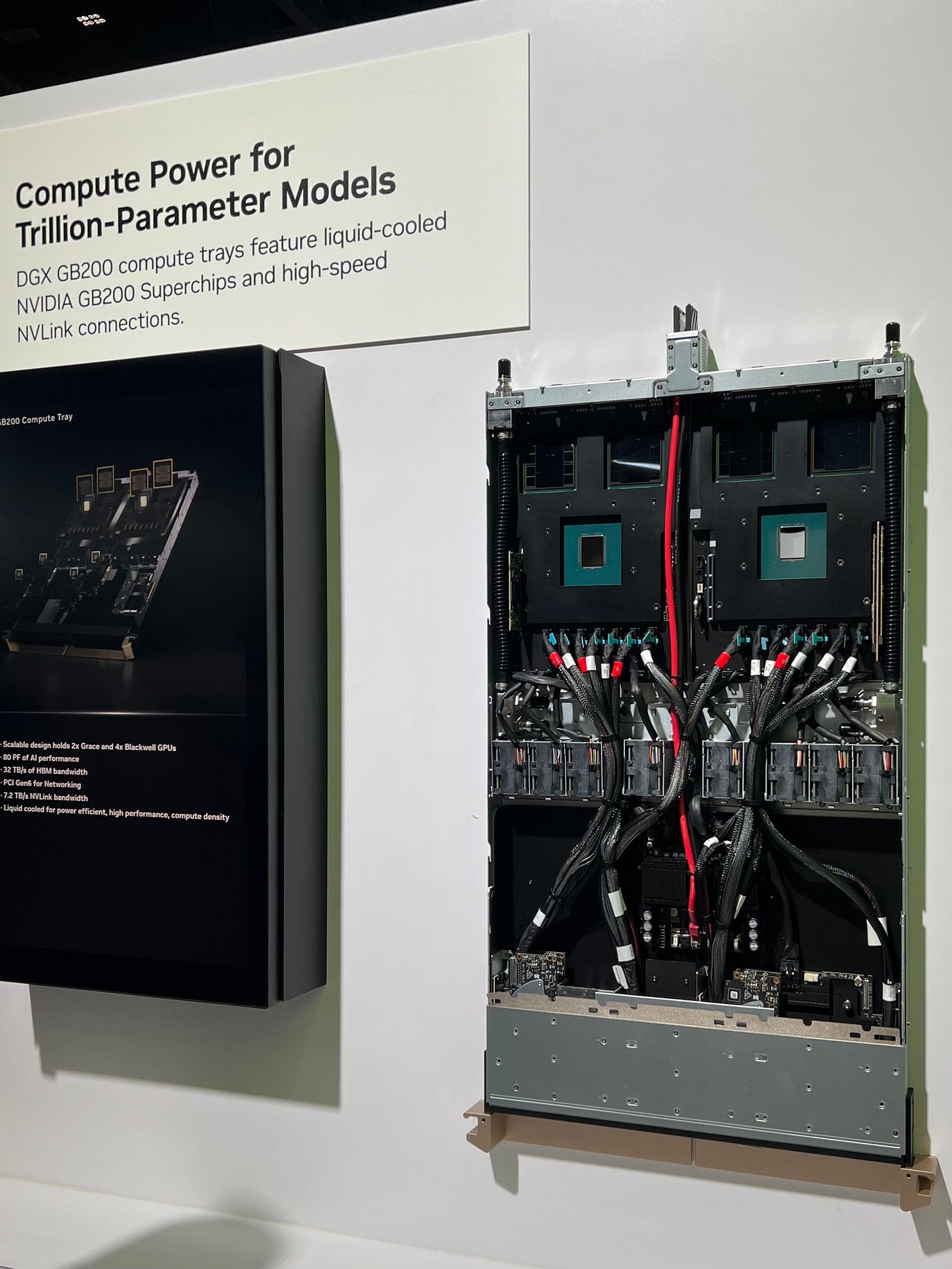

Rack scale system ramp schedule

MGX vs. DGX mix for Blackwell

Thoughts on the Stock from Here

Feel comfortable holding the stocks from here if you have a lower cost basis. EPS next year should fall in the $4.7-4.9 range, giving us lots of upside to go from here. From a timing perspective, however, there is less near-term catalysts as we are in the middle of two product cycles. 3Q #s should be no surprise and 4Q several billion$ Blackwell rev. is well guided.

Is there a chance NVDA can do more than several billions and surprise the market? Less likely, given supply chain readiness and production timeline, I will think about ~120-150K B100/200 in 4Q and ramp it from there.

When will Jensen surprise us again? Likely in 2H’CY25, but upside case would be 2Q results, as GB200 ramp kicking in with improving supply chain readiness.

We still think NVDA will prioritize GB over B100/200 with a 70/30 mix (or more), as they attempt to push for the new architecture and higher monetization. But keep in mind that GB will likely require a longer ramp cycle given its supply chain complexity.

Ramp schedule revisit Hopper vs. Blackwell

Revisiting the ramp of Hopper vs. Blackwell through taking quotes from each earnings call, we can intuitively notice the pushout, driven by change to the mask (re-taping happened) and complex new GB architecture design.

Some helpful notes based on my conversations:

Delay is not meaningful, maybe shorter than the consensus 3 months

4Q should be all about B100/200

GB will kick in with small volume in 1Q CY25

GB200A (use CoWoS-S, packaging B102 with Grace CPU) is single die and air-cooled, not the most performant. Don’t think CSPs will like it given the limited DC space